Think about Canadian banking. Your first thought is likely of its quarter-over-quarter, hand-over-fist profits. The unlikely thought is of an industry driving innovation. Yet when it comes to our money, innovation is happening at a pace that’s leaving the old school Canadian institutions breathless.

Digitization, mobility, and shifting demographic attitudes are driving disruption in the business of money. From saving money to borrowing money, lending money to spending money, Vancouver’s FinTech community is endeavouring to shake things up.

BetaKit spoke with seven different Vancouver FinTech companies at very different stages of their business lifecycle to understand what drove them to launch. The founders of Grouplend, Payso, WealthBar, RentMoola, Payfirma, Voleo, and Koho, also weighed in with thoughts on key trends driving change and what could unfold tomorrow.

Businesses aren’t often built from a single “eureka” moment. But each founder I spoke with was able to articulate a series of different “ah ha” moments that led them to launching.

Koho’s CEO and founder, Daniel Eberhard, said that it was “opening up a new account at my bank and realizing despite 10 years of being their customer, they knew nothing about me. The day we launched was also an important moment. It was more of a ‘thank god we’re not the only ones who feel this pain’.”

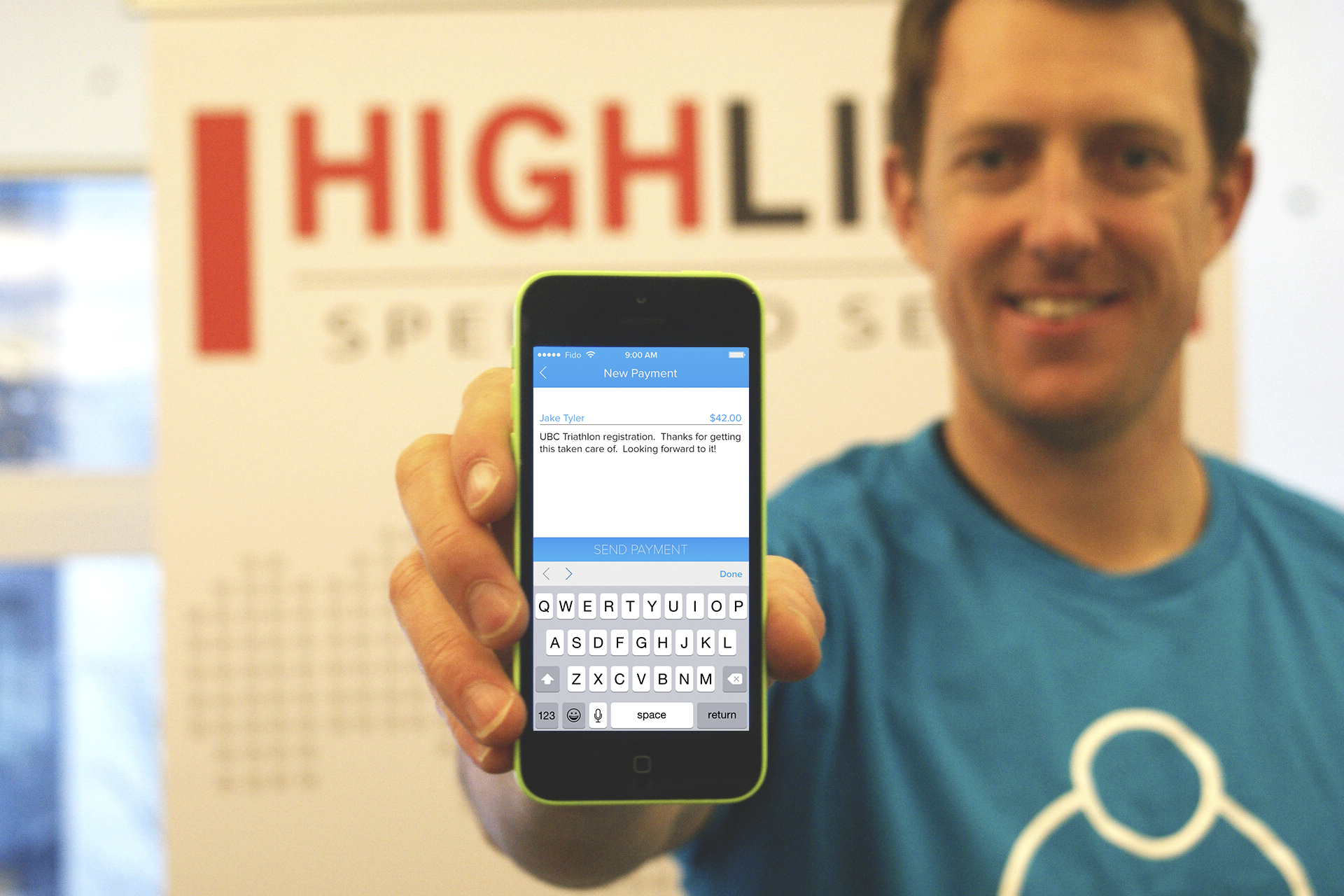

“I played basketball when I lived in London, and at the end of each game I’d have to collect fees from each player,” said Jake Tyler, CEO and founder of Payso. “This meant that after every game I was running around asking my buddies for money – which led to them either pulling out a pocket full of coins, a £20 note, or nothing at all and telling me they’d make it up next week. It started to frustrate me that I had all these awesome apps for sharing basically everything else in my life but nothing for sharing money. This is the fundamental problem Payso is solving.”

“Unbiased advice was something that only the wealthy can get.”

Rentmoola’s COO and co-founder, Philipp Postrehovsky, saw that “people still pay their rent with cheques and that you get nothing for paying your rent. With online and mobile payments being mainstream and even the Government of Canada phasing out cheques, earning rewards and making it simple to pay rent made too much sense.”

According to GroupLend’s CEO, Kevin Sandhu, “having worked in investment banking for a number of years, I was able to see the industry from the inside and it was a real point of frustration for me. The real ‘ah ha’ moment was when I realized that there was an unmistakable opportunity to leverage modern technology and data-driven systems to deliver financial products that solve problems for Canadians instead of create them.”

Tea Nicola, CEO and co-founder of WealthBar, said that, for her, it was “people looking more and more for an unbiased advice, and not being to able to get it if they do not have a lot of money to invest. Unbiased advice was something that only the wealthy can get. Mutual fund fees were too high for the current interest rate environment, and people’s investments were getting eroded by these high fees.”

Michael Gokturk, CEO and founder of Payfirma, told me that “the payments space is rooted in my passion for frictionless commerce. I’m proud to say Payfirma was the first to market in launching mobile point of sale in Canada. I saw potential in mobile payments for removing the pain points from purchasing and giving customers and merchants the ability to pay anywhere and anytime. I also saw how it could be used to positively transform the in-store experience. Apple is a great example of this: they use mobile point of sale in their stores to line bust and check customers out on the spot.”

As a former investment banker, Voleo’s CEO, Thomas Beattie, always followed the retail investing space with great interest. “Like many of us, we realized that the concept of active personal investing was dying, despite the fact that picking stocks and actively managing a portfolio can be a rewarding, fun, and liberating experience,” he said. “The ‘aha moment’ occurred when we realized that the investing experience was completely misaligned with the social norms of our generation – we interact through technology, collaborate and share for collective benefit, and value bringing more transparency to complex and convoluted industries.”

There’s no doubt that the very nature of the Canadian banking system helped shield us from many of 2008’s financial ills. Yet, tradition and establishment can’t be barriers to innovation. I asked everyone what has been their biggest challenge to date; the answers were varied, yet unsurprising, on the state of Canadian regulation.

Eberhard – “Banking, especially in Canada, is archaic. The challenge is most Canadians don’t know it. It’s going to be our job to shift people’s expectations in terms of what they should expect from their banking experience. Consumers had no issue with Blockbuster until they got Netflix. Same thing goes for taxis and Uber. When people don’t know something is broken, it’s a challenge to shift their mentality. If you can, you win big.”

Tyler – “Working with banks is definitely a big challenge for us. Canada is dominated by a small handful of large, powerful and very profitable banks and they tend to be pretty conservative when it comes to innovation and working with young companies like ours. We’d certainly like to see some of the rhetoric banks have about working with start-ups in the FinTech space flow through to actual banking relationships with these companies.”

Sandhu – “Like many companies on the bleeding edge of an industry, our biggest challenge is educating the market about our product and the ways that it can help them. For a long time, reasonably priced personal loans haven’t really existed in Canada. Many consumers resort to their credit cards to help them pay for life’s unavoidable expenses. That’s an expensive proposition for the consumer. We’re trying to change the way that people think about borrowing and credit, and that takes time and a lot of effort.”

“Banking, especially in Canada, is archaic. The challenge is most Canadians don’t know it.”

Nicola – “Regulatory challenges are always present, but they are not insurmountable, nor are they the biggest ones. I’d say the biggest challenge is a lack of technology infrastructure in the industry and the transaction costs associated with managing clients accounts. The transaction costs need to be a fraction of what they are today”

Gokturk – “There is a lot of amazing innovation happening in payments right now, but there is also a lag in terms of what Canadian merchants are asking for and using. Our mission is to make every merchant multichannel because our own data shows the benefits. Our top processing merchants are the ones who have activated four or more payment channels and they are selling 400% more than the one channel guys. Part of this process also means displacing well-entrenched incumbents and again, educating merchants that they could be getting so much more from a payments company.”

Beattie – “The regulatory environment has definitely been the biggest hurdle – the requirements are capital intensive and are structured to exclude new entrants. The regulatory red-tape makes validating product/market fit difficult for Fintech startups. However, it is an area where we are seeing business model innovation and new ways of obtaining early-stage customer feedback (e.g. Voleo will be offering a simulation based trading product ahead of real dollar accounts). Specifically to Voleo, obtaining broker registration is both costly and time consuming; not to mention that there are implications for the composition of our team (e.g. requiring 40% of our Board of Directors to be financial industry insiders).”

Stay tuned for part two of this profile, which will discuss opportunities beyond the Canadian marketplace, and what these founders see for FinTech’s future.

Featured image courtesy GroupLend.

Disclosure: Some of the startups mentioned in this article are HIGHLINE portfolio companies. BetaKit’s East and West Coast offices are housed in HIGHLINE’s Vancouver and Toronto co-working spaces.