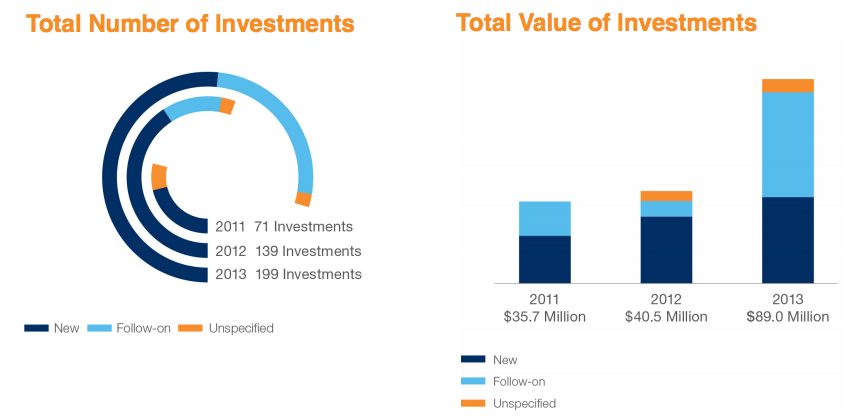

Angel investors in Canada collectively invested over $89 million in Canada in 2013, with groups in Central Canada investing the bulk ($70 million) of that money. Meanwhile, Canadian accelerator programs reported attracting more than $31.1 million in angel money, venture capital (VC) and government funding.

The new data comes from the National Angel Capital Organization’s (NACO) report entitled “2013 Report on Angel Investing Activity in Canada: Accelerating the Asset Class”.

Not all groups in Canada took part in the survey, which is important to remember: 29 of 33 angel groups approached participated in the survey, while 12 of 18 accelerator programs approached participated. Nevertheless, the yearly survey can act as a barometer for how the nation’s investing economy is performing.

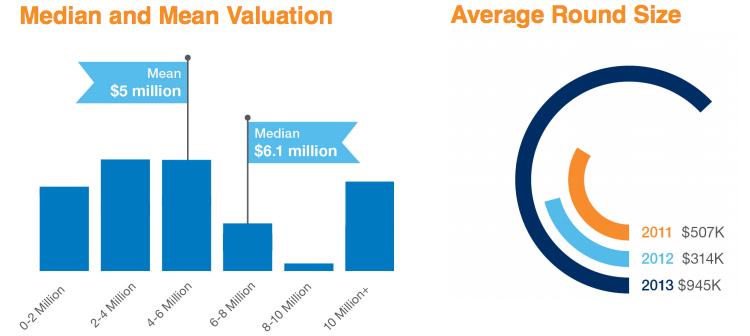

Most angel groups in Canada now claim about five years in existence, giving them the air of an “established institution in Canada”. These group have an average of 73 members, meaning that around 2,100 angels are making investments into Canadian companies.

“Reporting about $70 million in investments, Central Canada is responsible for the bulk of the $89 million invested by all groups. The remaining $19 million is almost entirely invested by groups in Western Canada. The median investment amount is also largest in Central Canada ($215,000), followed by Western Canada ($175,000) and Eastern Canada ($135,000),” read the report.

Investments were mostly focused on ICT, Life Sciences, and Clean Tech, with the median investment in ICT companies being $180,000, consistent with what we usually see as seed investment values. Clean tech investments had a median value of $573,000.

Investments were mostly focused on ICT, Life Sciences, and Clean Tech, with the median investment in ICT companies being $180,000, consistent with what we usually see as seed investment values. Clean tech investments had a median value of $573,000.

Moreover, angels appear “increasingly able and willing” to give follow-on funding to carry companies through the next stages of growth. The amount invested in follow-on rounds was at least 51 percent of the total amount invested in 2013, up from 42 percent in 2011 and 18 percent in 2012.

“We are encouraged by the results of this year’s report, which show that this important community continues to grow and become more connected. Working together, we are supporting more entrepreneurs with increased investment in more new and follow-on opportunities,” said NACO cochair Michelle Scarborough.

The report also mentioned accelerator programs made a splash in 2013, furthering their reputations. “Despite their young age, business accelerators have established themselves as an important element of the start-up ecosystem.”

The report also mentioned accelerator programs made a splash in 2013, furthering their reputations. “Despite their young age, business accelerators have established themselves as an important element of the start-up ecosystem.”

Consistent in what we’ve documented through articles like The Accelerator Series, “Across the group of accelerators, however, there are quite noticeable differences in the probability of acceptance, funding invested per company, number of mentoring hours, graduation criteria, graduation rates, and alumni engagement strategies. Program managers indicate they continuously work on experimenting with and improving their programs and business models,” read the report.

The survey also revealed that accelerator-backed companies are successful at attracting outside funding from Angels, VCs, Government and other investors, while in the program. In fact, only seven of 49 accelerator-backed companies had not attracted any outside funding by the end of the program, a noteworthy reduction from the 33 companies that had not attracted outside funding at the beginning of their programs. Angels lead the way as the biggest source of outside funding for accelerator-backed companies, with investments of $17 million.

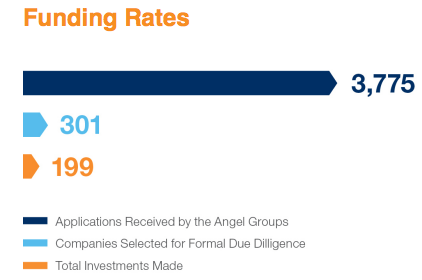

Another point of interest was the amount of companies that received investment after applying. 3,775 companies formally applied for funding in 2013 and just 301 went into the due diligence stage. Two-thirds of those companies actually received investment (199).

Since 2010, NACO said its yearly report has captured over $180 million in 475 investments.